The

Economics of the Stock Market Pt. 1

Understand the concepts that move the market:

Supply and Demand

"The law of supply and demand is more

important than all the analyst opinions on Wall Street."

- William J. O'Neil

The price of everything in our

capitalist society comes down to a simple equation - the

interaction of supply and demand. And the stock market is no

exception. In fact, the law of supply and demand is probably

more visible in the stock market than in any other market.

Consider your neighbourhood

supermarket. There the price of carrots or a can of soup may

seem unfathomable. That is because in most cases, the famous

invisible hand of Adam Smith controls prices. We do not know all

the details that have gone into determining the price - the

weather in growing areas, the incidence of insects that destroy

crops, the scarcity of tin and its effect on the price of cans.

We cannot simply draw a chart

to see where the price of a can of soup is and where itís going.

They just donít make soup charts or carrot charts

although

such information may be available to farmers and grocers in

specialized publications.

But the stock market is different. The prices change quickly

through a constant auction process. The interplay of buyers and

sellers can be seen in stock charts. These charts, as we shall

see, represent the law of supply and demand in action.

But first, letís get back to

basics. Some wags have said that economics is an inexact

science, nay, even a dismal science. Ask an opinion of ten

different economists and youíll get ten different answers.

Economics is held by many to be in disrepute. Or at least arcane

and incomprehensible. But what theyíre talking about is what is

usually known as macro-economics - an attempt to look at the big

picture. And that usually involves politics.

What economists of all stripes

universally agree on though, is micro-economics. The building

blocks and foundation of economics - the law of supply and

demand. Call it Economics 101. In this writerís opinion, it is

the only economics that matters because, at core, it explains

everything, even the diverse opinions of the macro-economists.

How can that be? The opinions of the macro-economists depend on

certain assumptions, and given these assumptions are correct,

their conclusions are correct. The problem is different

economists make different economic assumptions.

So letís get on to the only

economics that matters - micro-economics. For those familiar

with the subject, it will be a handy refresher. For novices,

the explanation should be clear and easy to follow and lay the

groundwork for parts two and three of the article.

Economics 101

In a nutshell, all other

things being equal, a seller will prefer to get a higher price

for his product rather than a lower price. And conversely, a

buyer prefers to pay less for the goods he buys rather than

more.

Thatís it. Lesson over.

Class dismissed!

What, you say? Thatís it? But

when I took Economics 101 in university they gave us a big huge

textbook, hundreds of pages of excruciating boredom!

That may well be, but the

above lesson is the essence of economics. Everything else is

elaboration on this theme. So letís elaborate briefly.

A key part of the lesson is

ďall other things being equalĒ. Thereís the rub. They never

are.

Letís consider the concept of

supply. The law of supply says that sellers prefer higher

prices. One corollary is that, if prices rise, more sellers are

attracted to the market, increased supply will be available, and

competition for customers will pull prices down again.

Suppose there are a certain

number of people making the economistís favourite product -

widgets. Theyíre selling at a certain price, but the widget

makers realize that people really like widgets and that they can

raise the price of widgets and still sell them all. So they do.

What happens now is that

potential widget makers who found the previous profit level of

widget manufacturing to be uneconomic will now start making

widgets. The supply will increase. But people donít want any

more widgets than they did before, so some go unsold. In order

to sell all their widgets, the manufacturers start lowering

their prices.

Letís look at it from the

demand side. People really like widgets so the manufacturers

raise prices. They still sell all of them. But they get greedy

and raise the prices even more. Now some of the widget consumers

say ďForget it! Iím not paying that high a price for widgets.Ē

So manufacturers are left with unsold widgets and are forced to

reduce their prices to sell them all.

This interplay of buyers

wanting to pay less and sellers wanting to charge more is the

law of supply and demand in action.

It explains why stores put

things on sale when they are not selling well. The rationale is

that a lower price will induce more people to buy. It also

explains why a shortage of a product, say oranges because of a

bad crop due to unseasonable weather, causes the price to rise.

With lots of oranges (supply) in the market, the growers must

charge a certain price to sell them all. But some of those

consumers of oranges are actually willing to pay more for their

oranges. Not everyone, but some. When the supply falls because

of bad weather, the orange growers donít have to worry about the

people who only want cheap oranges. They can charge a higher

price because the number of people willing to pay the higher

price will buy all of the smaller number of oranges. But they

canít raise the price indiscriminately. If they raise the price

too much, theyíll still be stuck with unsold oranges.

This interplay of buyers and

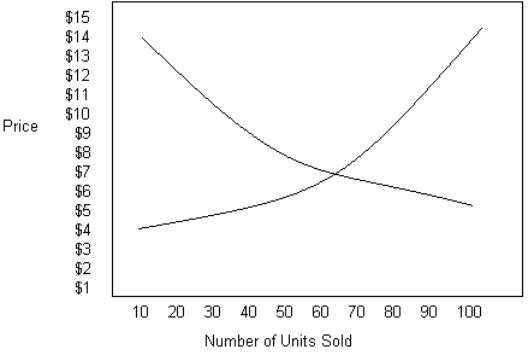

sellers can be graphically depicted as shown below.

The line sloping from the upper left to the lower right is

the demand curve. The line sloping from the lower left to the

upper right is the supply curve. They show that widget

manufacturers are willing to produce more widgets as the price

goes up. And conversely, widget consumers want to purchase more

widgets as the price goes down. Equilibrium, in this example,

is 65 widgets at $7.

If widget manufacturers charge a higher price, they will be

left with unsold widgets. If they charge a lower price, the

widgets will sell out quickly and there will be a shortage. So

whenever a price different than the equilibrium price is

charged, someone will be unhappy. Interestingly enough, it is

not the people you might expect to be unhappy. If the price is

too high, producers are unhappy because they are left with

unsold stock and high inventories and must cut back production.

If the price is too low, consumers are unhappy because they

canít get all the widgets they want.

Putting this into numbers, if the price charged is $10, only

30 widgets will be sold. Manufacturers produced 65 and are

stuck with 35 left over. If the price is only $5, widget

consumers want 100 widgets but can only get 65.

So how, you might ask, do prices change? Prices change when

the whole supply or demand curve shifts. If a successful

advertising campaign convinces consumers that they just need to

have a widget and consumers are willing to pay more, then the

demand curve shifts to the right. Prices go up. Conversely, if

consumers want less of the product - the product was a fad such

as the pet rock or the hula hoop - the demand curve shifts to

the left. Prices fall.

On the supply side, if manufacturers canít produce at the

current market price because it doesnít cover their costs, they

will cut back production. The supply curve shifts to the left.

Conversely, if improved technology lets producers cut costs,

they will be able to cut prices while maintaining profit

margins. At a lower price, customers will be willing to buy

more, so the producers oblige and make more. The supply curve

shifts to the right.

All of these other factors are the other things that are

never equal, as Iíve noted. The interplay of all these factors

make for shifting supply and demand curves and even changes in

the shape of the curves. This dynamic flux creates the price

structure of the capitalist market system.

It is a thing of beauty to contemplate because all of the

myriad changes in fashions, technology, costs of production, and

so on interact to produce the right price at the right time as

if by an invisible hand - just as Adam Smith put it so

brilliantly. We might gripe about the price of oranges going up,

but if it didnít, we would soon find ourselves with a shortage.

Letís review some of the concepts and ideas weíve covered

about supply and demand.

Supply

All things equal, sellers prefer higher prices to lower

prices.

All things are never equal, but in constant flux.

Some of the things that change on the supply side are

Demand

All things equal, buyers prefer lower prices to higher

prices.

All things are never equal but in constant flux.

Some of the things that change on the demand side are

- increased or decreased wealth of the consumer

- change in tastes, fashions and fads

- new knowledge about competing products

- decisions to substitute one product for another because of such

knowledge (e.g. - substituting margarine for butter)

These lists are examples of factors affecting supply and

demand and are not exhaustive.

The question now is, how does supply and demand affect the

stock market. Here are some general principles to

consider.

Part 2:

Supply and Demand and the Stock Market

Part 3: What the Charts

Tell Us